Why Due Diligence matters

The importance of personality analysis in investment decisions

Due diligence is a crucial part of any investment decision, especially when it comes to startups. While financial, legal, and tax aspects are often thoroughly examined, there is one aspect that is sometimes overlooked: the personality of the founders. This article explains why personality analysis is so important for founders and investors, and how it can be integrated into due diligence processes.

First invest in personalities – Then in ideas

Ideas are a dime a dozen, but the personalities of the founders play a decisive role in determining how successful the implementation will be. Therefore, investors should not only check the business in their due diligence, but also the personality behind it. Research shows that an ideal founder personality consists of optimism, a willingness to take risks, and a strong belief in one’s own abilities. In addition, an open, curious, extroverted, and emotionally stable mentality is desirable. By investing in personalities first, investors can reduce the risk of their investment and increase their chances of success.

“Risk comes from not knowing!” – Warren Buffett

Warren Buffett’s quote is particularly relevant when it comes to the personality of the founders. To reduce the risk of investment, it is advantageous to learn as much information as possible about the founders. In this way, horror scenarios like the case of the men’s outfitter “Von Floerke” can be avoided. Four years after the founding of the start-up, the company was on the verge of going out of business – founder David Schirrmacher mocked and agitated against Frank Thelen, his investor, in public. The latter, in turn, described Schirrmacher as no longer sane. The personality of the founder is therefore an essential component to know in advance exactly what you are getting into.

The Corona Crisis makes getting to know someone in person difficult

The Corona crisis has made it difficult for investors and founders to get to know each other in person. Investors and founders normally get to know each other better over a cozy dinner or on a joint date, which is currently absolutely unthinkable. A digital meeting must be enough to decide whether to invest in the founders or not. However, this can come with a high risk. Biased decisions, misjudgments, and missed opportunities are becoming more common. A personality analysis can help mitigate these risks.

“Self-Presentation” – A Dealbreaker

Self-presentation and social desirability are familiar to all of us. One presents oneself better or differently than one is to score points with the other person. Finding the true core behind the facade as an investor is more difficult than you might think. Especially in front of the webcam, it is easy to pretend to convince others. A personality analysis can help investors see through self-presentation and make a more informed decision.

60% of All Startups Fail Due to an Unfavorable Team Composition

Recent research on failed startups from Harvard Business Review shows that 60% of startups fail because of the wrong personalities and constellations within the team. However, not all hope is lost. This can be preemptively counteracted. Through a personality analysis, the team can be evaluated in detail. Which personalities are represented in the team and how do these types harmonize with each other? In this way, everyone can be deployed according to their strengths and contribute to the success of the company in the long term.

In conclusion, personality analysis is an important aspect of due diligence that should not be overlooked. By investing in personalities first, investors can reduce the risk of their investment and increase their chances of success. The Corona crisis has made it more difficult to get to know the founders in person.

Why should psychology be considered in due diligence?

When it comes to conducting due diligence, most people focus on analyzing financial statements, legal documents, and other technical information. However, it’s important not to overlook the role of psychology in due diligence. Here are some reasons why psychology should be considered when conducting due diligence.

“I can do it!”

Founders are characterized by optimism, resilience and self-efficacy conviction. All values are measurable and trainable. Why is that?

Successful founders have strong personal resources. They are particularly optimistic, resilient and at the same time convinced of their own effectiveness.

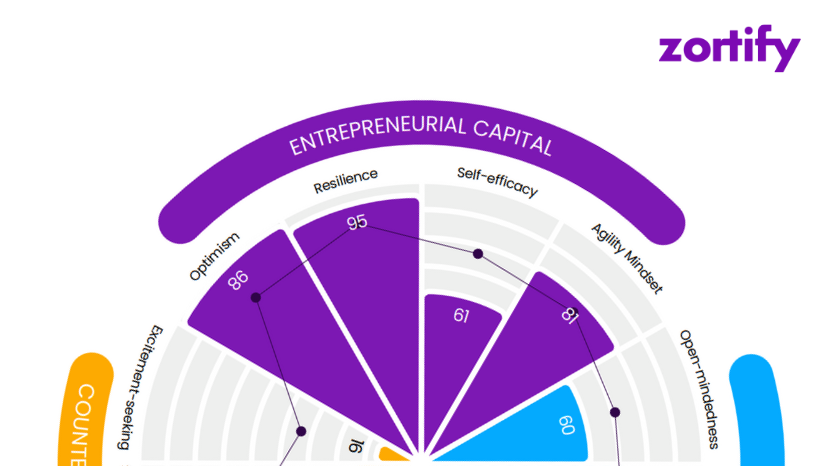

What is Entrepreneurial Capital that we measure at Zortify?

Entrepreneurial capital is like a secret weapon for business people, whether you are an entrepreneur, corporate employee or leader – you want to score high in entrepreneurial capital. It’s made up of certain mental powers that help you do well in your work and handle challenges bravely. It’s not about skills or personality traits, it’s about your mindset, how you think and deal with things.

Subscribe to Our Newsletter

Are you ready to shape the future of work and transform your HR strategies? – In our newsletter, we write about relevant topics between AI and HR and the fantastic new possibilities that artificial intelligence brings to modern People Management.

Why should psychology be considered in due diligence?

When it comes to conducting due diligence, most people focus on analyzing financial statements, legal documents, and other technical information. However, it’s important not to overlook the role of psychology in due diligence. Here are some reasons why psychology should be considered when conducting due diligence.

According to Oxford Languages, the definition of Due diligence in this matter is:. A comprehensive appraisal of a business undertaken by a prospective buyer, especially to establish its assets and liabilities and evaluate its commercial potential.

Understanding the Human Element

At its core, due diligence is about understanding the risks and opportunities associated with a potential investment. And when it comes to risks and opportunities, it’s important to consider the human element. Understanding the people involved in a potential investment, including their personalities, motivations, and decision-making processes; can provide valuable insights into the potential risks and opportunities associated with that investment.

For example, if a potential investment involves a CEO. Who has a history of making impulsive decisions or has a reputation for being difficult to work with. This could be a red flag that suggests additional risks that should be investigated further. Alternatively, if a potential investment involves a management team. That has a proven track record of successfully navigating difficult market conditions. This could be a positive sign that suggests that the investment may be less risky than it appears on the surface.

Assessing Cultural Fit

In addition to understanding the personalities and motivations of key individuals involved in a potential investment. It’s also important to consider the cultural fit between the investment and the investor. This includes not only the culture of the company or organization being invested in but also the culture of the investor.

For example, if an investor values social responsibility and environmental sustainability. They may be reluctant to invest in a company that has a history of violating environmental regulations or engaging in unethical business practices. Similarly, an investor who values transparency and open communication. He may be wary of investing in a company that has a history of being secretive or opaque about its operations.

By considering the cultural fit between the investment and the investor, due diligence can help to identify potential areas of misalignment that could ultimately lead to problems down the line.

Mitigating Bias and Emotion

Another reason why psychology is important in due diligence is that it can help to mitigate bias and emotion. When people make investment decisions, they are often influenced by a range of cognitive biases and emotions. Such as confirmation bias, overconfidence, and fear of missing out.

By incorporating a psychological perspective into the due diligence process, it’s possible to identify potential biases. As well as emotions that could affect judgment and develop strategies to mitigate them. This could involve conducting surveys or interviews to gain a better understanding of the emotional and cognitive factors that may influence decision making. Or decision making frameworks could be developed that aim to counteract common biases and emotional reactions.

Ensuring a Holistic Approach

Ultimately, the goal of due diligence is to ensure that all potential risks and opportunities associated with a potential investment are thoroughly assessed. By considering the role of psychology in due diligence, it’s possible to ensure a more holistic approach. That takes into account not only the technical aspects of the investment. But also the human and cultural factors that can influence the success or failure of an investment.

Conclusion

When conducting due diligence, it’s important not to overlook the role of psychology. By understanding the personalities, motivations, and decision-making processes of key individuals involved in a potential investment. As well as the cultural fit between the investment and the investor. Due diligence can help to identify potential risks and opportunities that might otherwise be missed. Additionally, by bringing a psychological perspective to due diligence, it’s possible to mitigate biases and emotions that may be clouding judgment. And to ensure a more holistic approach that takes into account all potential factors that can influence the success or failure of an investment.

Why Due Diligence matters: The importance of personality analysis in investment decisions

Due diligence is a crucial part of any investment decision, especially when it comes to startups. While financial, legal, and tax aspects are often thoroughly examined, there is one aspect that is sometimes overlooked: the personality of the founders.

“I can do it!”

Founders are characterized by optimism, resilience and self-efficacy conviction. All values are measurable and trainable. Why is that?

Successful founders have strong personal resources. They are particularly optimistic, resilient and at the same time convinced of their own effectiveness.

What is Entrepreneurial Capital that we measure at Zortify?

Entrepreneurial capital is like a secret weapon for business people, whether you are an entrepreneur, corporate employee or leader – you want to score high in entrepreneurial capital. It’s made up of certain mental powers that help you do well in your work and handle challenges bravely. It’s not about skills or personality traits, it’s about your mindset, how you think and deal with things.