Why Due Diligence matters

The importance of personality analysis in investment decisions

Due diligence is a crucial part of any investment decision, especially when it comes to startups. While financial, legal, and tax aspects are often thoroughly examined, there is one aspect that is sometimes overlooked: the personality of the founders. This article explains why personality analysis is so important for founders and investors, and how it can be integrated into due diligence processes.

First invest in personalities – Then in ideas

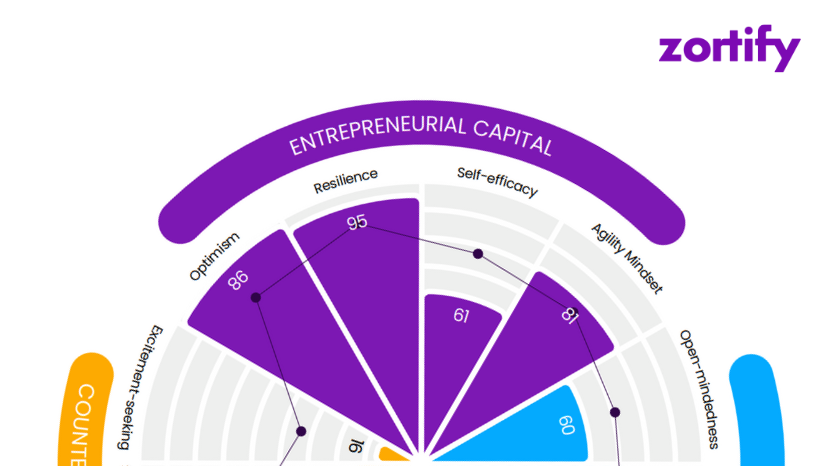

Ideas are a dime a dozen, but the personalities of the founders play a decisive role in determining how successful the implementation will be. Therefore, investors should not only check the business in their due diligence, but also the personality behind it. Research shows that an ideal founder personality consists of optimism, a willingness to take risks, and a strong belief in one’s own abilities. In addition, an open, curious, extroverted, and emotionally stable mentality is desirable. By investing in personalities first, investors can reduce the risk of their investment and increase their chances of success.

“Risk comes from not knowing!” – Warren Buffett

Warren Buffett’s quote is particularly relevant when it comes to the personality of the founders. To reduce the risk of investment, it is advantageous to learn as much information as possible about the founders. In this way, horror scenarios like the case of the men’s outfitter “Von Floerke” can be avoided. Four years after the founding of the start-up, the company was on the verge of going out of business – founder David Schirrmacher mocked and agitated against Frank Thelen, his investor, in public. The latter, in turn, described Schirrmacher as no longer sane. The personality of the founder is therefore an essential component to know in advance exactly what you are getting into.

The Corona Crisis makes getting to know someone in person difficult

The Corona crisis has made it difficult for investors and founders to get to know each other in person. Investors and founders normally get to know each other better over a cozy dinner or on a joint date, which is currently absolutely unthinkable. A digital meeting must be enough to decide whether to invest in the founders or not. However, this can come with a high risk. Biased decisions, misjudgments, and missed opportunities are becoming more common. A personality analysis can help mitigate these risks.

“Self-Presentation” – A Dealbreaker

Self-presentation and social desirability are familiar to all of us. One presents oneself better or differently than one is to score points with the other person. Finding the true core behind the facade as an investor is more difficult than you might think. Especially in front of the webcam, it is easy to pretend to convince others. A personality analysis can help investors see through self-presentation and make a more informed decision.

60% of All Startups Fail Due to an Unfavorable Team Composition

Recent research on failed startups from Harvard Business Review shows that 60% of startups fail because of the wrong personalities and constellations within the team. However, not all hope is lost. This can be preemptively counteracted. Through a personality analysis, the team can be evaluated in detail. Which personalities are represented in the team and how do these types harmonize with each other? In this way, everyone can be deployed according to their strengths and contribute to the success of the company in the long term.

In conclusion, personality analysis is an important aspect of due diligence that should not be overlooked. By investing in personalities first, investors can reduce the risk of their investment and increase their chances of success. The Corona crisis has made it more difficult to get to know the founders in person.

Why should psychology be considered in due diligence?

“I can do it!”